Did Bet365 Completely Cease Operations in India?

On the 18th of August 2023, Bet365 restricted Indian accounts, as they have decided to withdraw from the market. We believe this is owing to the changes in law and taxation rules.

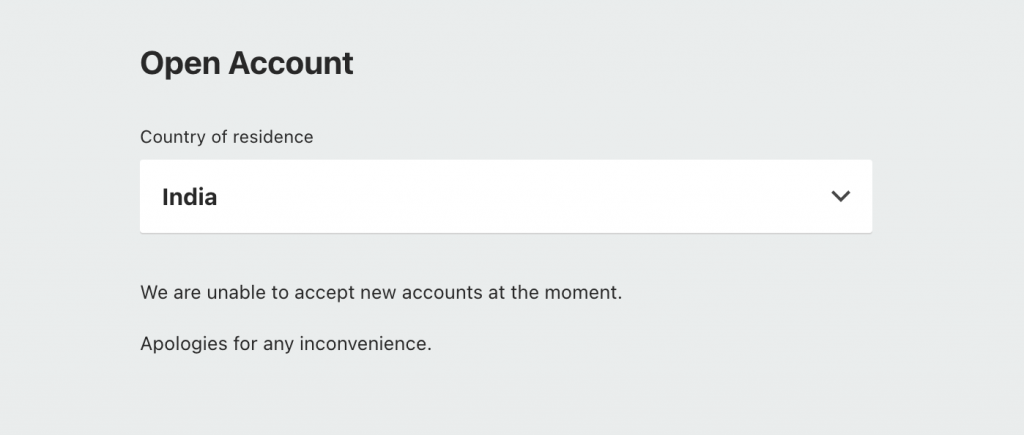

Now, when you try to create a new account from India, it says that Bet365 cannot accept new accounts.

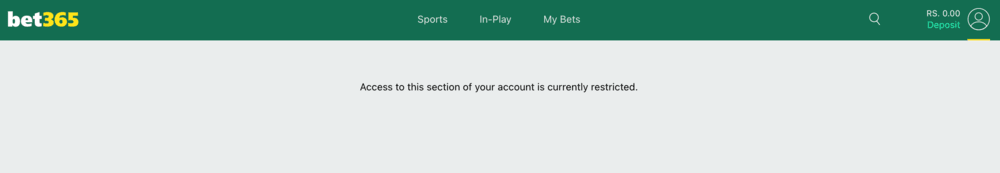

However, existing accounts can log in and browse the site but cannot make deposits in their account since the deposit page is restricted.

And when you do try to place the bet, the authenticator app does not respond to the QR code on the screen (at least, that was the case for us).

In case you didn’t know, the authenticator app is an added layer of security used to confirm your bets.

So, what happens to your bets and withdrawal balances now?

Don’t worry; Bet365 has you covered.

Bet365 Active Bet and Balance Settlement

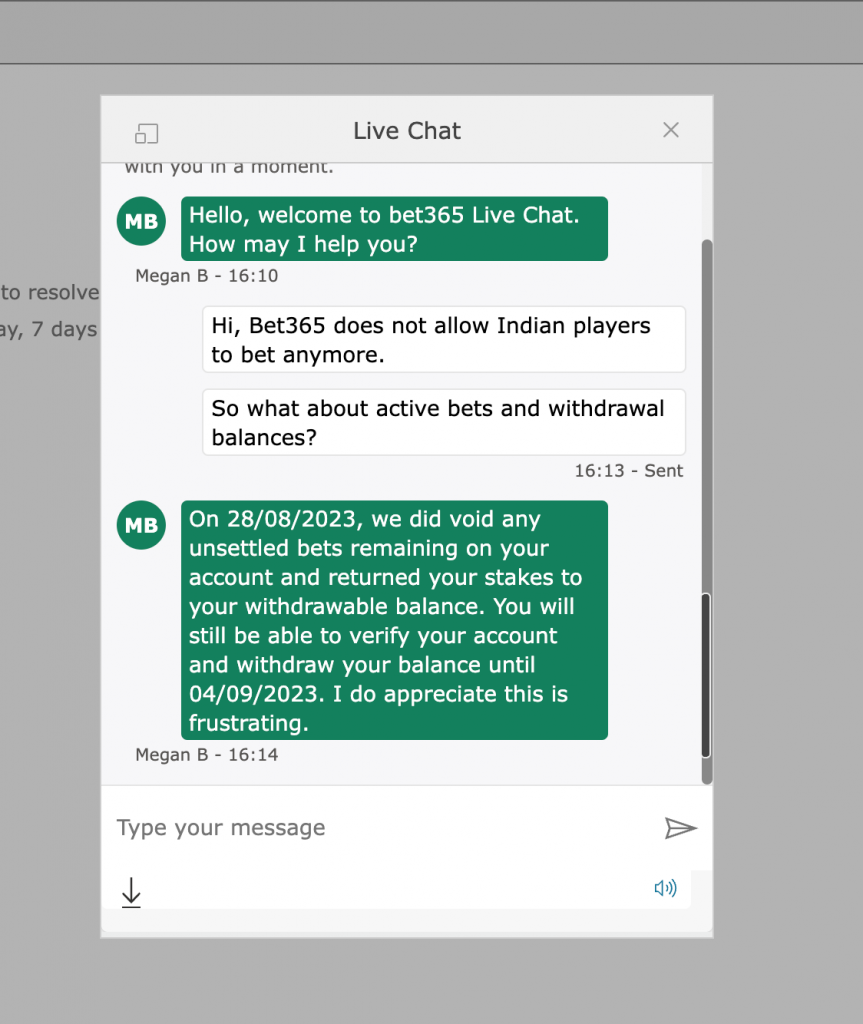

To give you accurate info, we wanted to get in touch with the Bet365 team (what better than to hear it directly from the horse’s mouth, right?).

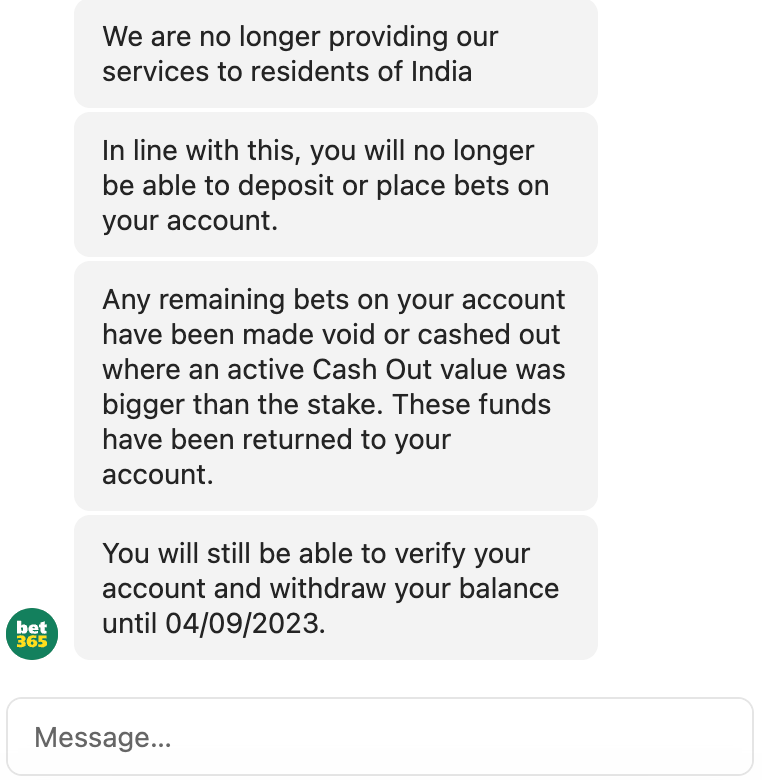

When we opened the chat, the virtual assistant (almost instantly) confirmed restrictions on Indian users.

Furthermore, it said that all bets have been settled by either making them void or cashing out.

Don’t worry, the cash out was only done if the amount was higher than the stake. You can see this amount on the withdrawal page.

Coming to withdrawals, you have up to 4 September 2023 to make withdrawals using the payment modes available on the site (so hurry up).

To further double-check the info, we contacted their support staff via chat (feel free to do that in case you have questions as well).

And they confirmed the same.

So yes, your money is safe for now, but make sure you withdraw it in time.

And once you do that, here are a few other reliable sportsbooks that are equally good.

That means they also support live betting, give you important stats, have a smooth user interface, an app for easy betting, and some even allow live streaming.

Oh, and some have a way better bonus than Bet365 (you can get up to ₹10,000 as a deposit bonus). Wondering where?

Check these sportsbooks out:

Trusted Bet365 Alternatives

Wondering what might have made Bet365 take this decision? We have some theories.

Possible Reasons for the Restrictions

New Amendments

So what are these new amendments, and how do they impact Bet365?

The section is our interpretation of the laws. It is not legal advice; we do not owe any duty of care to readers. All readers should seek legal counsel to make legal or business decisions or for guidance.

As per the amendments made to the Information and Technology Act 2000, only those online real money games will be allowed in India that have approval from Self Regulatory Bodies (SRBs).

The Ministry of Electronics and Information Technology (MeitY) plans to set up multiple SRBs to overlook the adherence to MeitY’s framework for online real money games.

These SRBs will include psychologists, industry stakeholders, etc., with organizations like the All India Gaming Federation and E-Gaming Federation vying for MeitY approval.

Another important clause is Section 3 Clause (a).

As per the clause, any platform or game that allows wagering on outcomes is not in a position to get MeitY or SRB approval.

However, the question remains whether wagering on outcomes is the only issue.

Can Bet365 and other sportsbooks allow wagering on any game of skill like horse racing and get approval from SRBs?

It is also important to note that the new amendments do not include any fines or punishment for players.

Plus, the SRBs do not have the authority to file for legal action against any sportsbook or users.

Only if you bet from Telangana, Andhra Pradesh, and Tamil Nadu you could be fined or punished.

This is because the new betting laws do not overrule the bans put in place by state governments.

Since a complete ban on betting is only in 3 states, SRBs are yet to be formed, and there are ambiguities in the law, we do not believe these were a major factor in Bet365’s decision.

Not to forget, we are months away from the formation of SRBs.

What we believe could be the major turning point is the change in taxation rules.

New Tax Rules

India introduced changes to tax rules in July 2023 that would most likely become active in October 2023.

Here’s what it means.

Online sportsbooks, casinos, and horse racing clubs would now be charged a 28% tax on the full value of deposits made by players.

This would greatly impact sportsbook earnings. Experts believe this move will impact industry growth, with many startups to shut shop.

So why aren’t all sportsbooks restricting Indian accounts?

Online gaming laws in India are ever-evolving, and there’s a chance they are waiting to see how these new rules impact them before taking drastic measures.

There’s also a chance that this is temporary and that Bet365 will open doors to Indian accounts soon.

Why Bet365 is a Trustworthy Sportsbook?

Do note that Bet365 does not accept Indian accounts now.

But since Bet365 is a trusted platform, we believe its features can help you understand the kind of standards sportsbooks should meet to be top-rated.

So, let’s jump straight to it.

Firstly, it is also one of the few sportsbooks to have licenses in multiple countries like the UK, France, Germany, the US, etc.

Bet365 uses the latest encryption technologies to ensure that all payment options are secure.

Furthermore, the use of sophisticated fraud detection systems that will recognise any suspicious activity on your account.

They also undergo to ensure complete safety by independent third-party companies such as eCOGRA and TST (Technical System Testing)

This is done to certify their random number generators (RNGs) are fair and honest.

If you want to learn more about Bet365, we tried and tested the sportsbook and described the pros and cons in detail in our Bet365 review.

Is Bet365 Taxable in India?

Yes, all sports betting winnings are taxable in India.

This includes the last withdrawals you make from Bet365 before the 4 September 2023 deadline since Bet365 no longer accepts Indian accounts.

According to section 115BB of the Income Tax Act, all earnings from online betting and gambling attract a flat 30% tax rate without cess.

That rate grows to 31.2% when the cess is included.

Takeaway

Since Bet365 has restricted India accounts, we’d recommend switching to alternatives like 22Bet, Parimatch, 1xBet, etc.

We also look forward to the SRB frameworks providing better clarity on new laws and the situation of online betting in India.

Plus, we’ll also have a better idea of the tax rules in October and their impact on the industry.

Until then, don’t forget to withdraw your winnings from Bet365 and use the recommended alternatives to Bet365.

FAQs

Can I use VPN for Bet365?

We do not advice you to use VPN to acces Bet365. While using a VPN is not illegal in India, your actions on website may be subject to Indian or international law that can have serious consequences. Not to forget, if Bet365 finds out your account is from India, you’ll like lose winnings and deposits, as they don’t accept Indian accounts.

Is Bet365 Legal in Karnataka?

While the Karnataka government did move to ban online gaming, the ban was struck down by the court which means the legal grey area for online betting continues to exist in Karnataka. However, Bet365 does not accept Indian accounts, so you can use alternatives like 22Bet.

Is Bet365 is Legal in Andhra Pradesh (AP)?

No, Bet365 is not legal in Andhra Pradesh and users can be fined and punished for online betting. The ban came into force in 2020 after the state government amended the AP Gaming Act 1974 to include online betting and gambling.

Is Bet365 is Legal in Telangana?

No, Bet365 is not legal in Telangana either. That’s because, like the AP government, the Telanaga government also amended the Telanaga Gaming Act to ban online betting and gambling.

Which Countries Bet365 is Legal?

Some of the countries where Bet365 is legal include, the UK, Austria, Germany, Spain, Ireland, Serbia, Czech Republic, Greece, Bulgaria, Norway, etc.